- 67% of those surveyed believe digital innovation will either transform (29%) or effect significant change (38%) to the infrastructure market over the next two years.

- 57% of respondents said that delayed payments from clients was one of their five leading external challenges.

- 83% of respondents agree on the importance of private sector funding.

- 52% of respondents identified risk and change management as one of their organisation’s five most pressing internal challenges.

Sharply falling oil prices and the impact of COVID-19 has resulted in the capital projects and infrastructure industry in the Middle East navigating a perilous market landscape, forcing many projects to either be cancelled or temporarily placed on hold.

PwC’s latest Middle East Capital Projects and Infrastructure Survey, conducted between February and April 2020, captured the evolving sentiment of industry leaders as the pandemic progressively influenced their strategic thinking. The data was gathered during a “pre-COVID-19” period before 3 March 2020, the time frame relevant to the Middle East, and a subsequent “during-COVID-19” period after 3 March 2020.

The survey outlines how the economic shock due to COVID-19 and the lower oil prices has compelled the industry to address long-standing issues such as lax project management and inadequate technology.

When asked to name the top key challenges facing organisations in the region, 52% of respondents identified risk and change management as one of their organisation’s five most pressing internal challenges. Whereas, financial performance (40%) was ranked third as a major internal challenge, while 37% of respondents said funding and financing remained an issue.

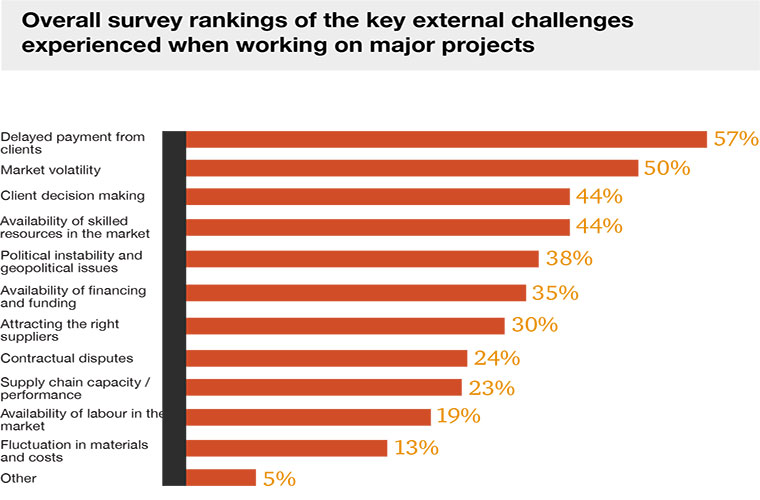

Externally, 57% of respondents identified delayed payments from clients which did not vary much between the pre 3 March and post 3 March results, underscoring the degree to which delayed payments are an enduring issue for the industry due to the length of supply chains. On the other hand, there was a significant difference between the pre and post 3 March results regarding market volatility, ranked second (50%) in the overall survey as a major external challenge.

The survey finds that the pandemic pushed organisations to digitalise functions and operations. Where 67% of those surveyed believe digital innovation will either transform (29%) or effect significant change (38%) to the infrastructure market over the next two years.

COVID-19 has also sharpened the perceptions about the top five technologies to disrupt the industry in the next two year with two thirds (66%) of the post 3 March 2020 sample identifying Artificial Intelligence (AI) and machine learning in their top five, compared with just 50% in the pre-COVID-19 sample. Simply waiting for better times to upgrade technology and address operational challenges is no longer an option. The time for action is now.

“The overall message from the survey is clear: technology will be the major enabler for organisations as they optimise costs and improve productivity in order to maximize value from capital portfolios and address the daunting challenges that lie ahead” said Andrew Stead, PwC Middle East Capital Projects Services Partner.

83% of the survey respondents agree on the importance of private sector funding, in line with the 2018 survey (80%). Survey respondents are acutely conscious that successful projects will depend more than ever on deeper private sector involvement and greater public investment efficiency, given the impact of the oil price and COVID-19 on state budgets. More recently, Qatar’s new PPP law, announced in May 2020, aims to facilitate private investment in a pipeline of projects in various sectors.

Maarten Wolfs, PwC Middle East Capital Projects and Infrastructure Leader said: “Over the past two years, we’ve seen a gradual increase in countries across the Middle East looking at alternative ways to attract finance to the region. The dual crisis has accelerated the need for Public Private Partnerships and as governments look to reduce their capital expenditure even further, we expect to see a further increase in private financing to help bridge the funding gap and kickstart projects.”

For the full report: [https://www.pwc.com/m1/en/publications/capital-projects-infrastructure-survey-2020.html]