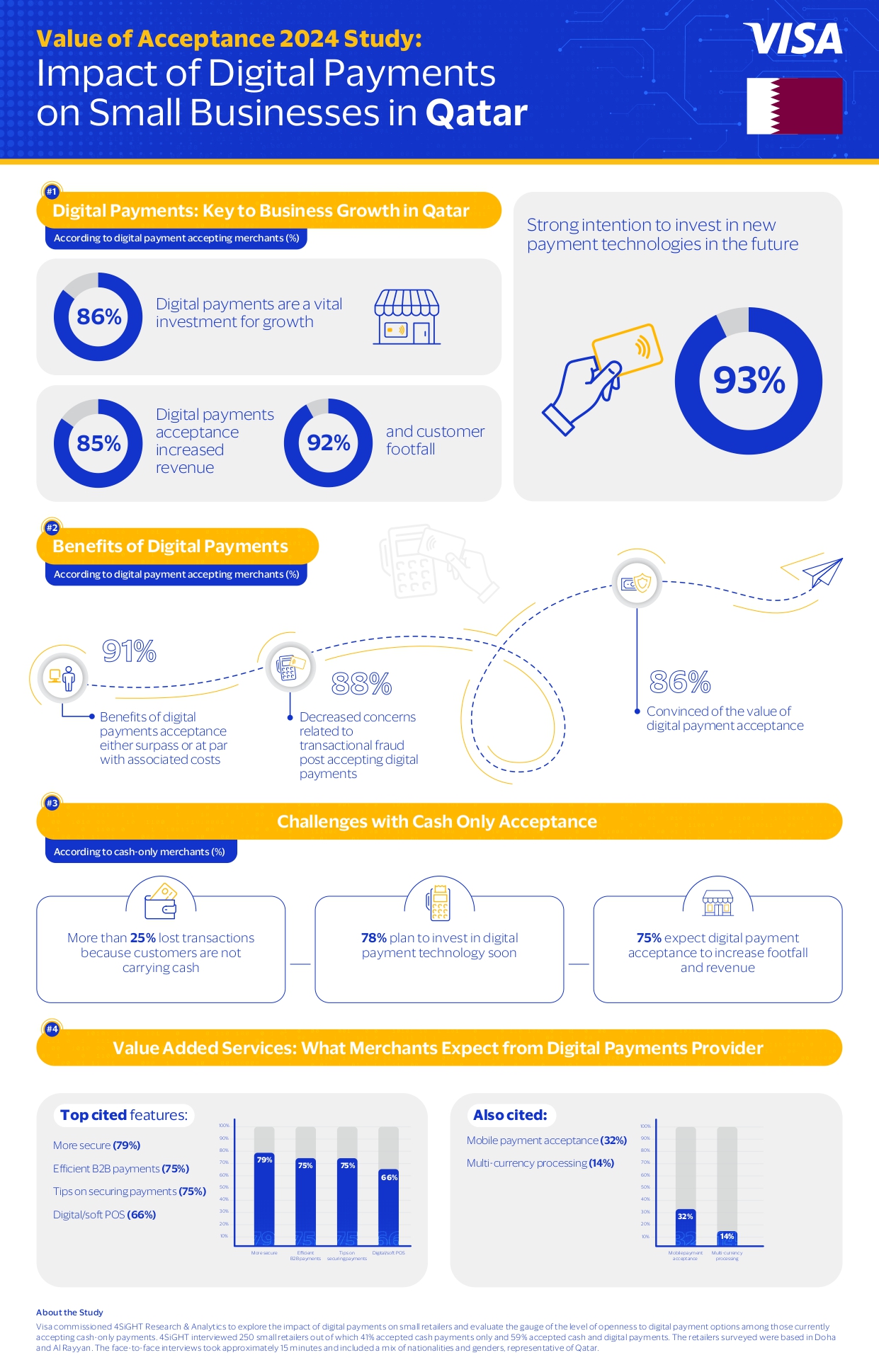

Visa (NYSE:V), a world leader in digital payments, has unveiled the results of an independent study titled ‘Value of Acceptance’, which explores merchants’ attitudes towards digital payments and the impact of digital commerce on small businesses and retailers in Qatar. According to the study, 86% of surveyed merchants accepting digital payments claimed acceptance of payment through card and mobile wallets is an essential investment significantly contributing to their business growth.

The survey gathered insights from two groups of Qatar-based merchants - those who have accepted digital payments for 1-4 years, and retailers who exclusively deal in cash transactions. The top five store types represented in the survey include mobile shops, tailors/shoe repair, quick service restaurants, small grocery, and fashion/apparel with business sizes including nano (2 or less employees), micro (3-10 employees) and small (11-49 employees). According to the study, among digital payment-accepting merchants, both digital payments and cash together account for more than 95% of payments accepted among surveyed small businesses.

Digital Payments: Business Growth Driver

The findings from Visa’s study show digital payment acceptance is an important driver in the growth of small businesses, with 85% of retailers surveyed claiming increased revenue and 92% seeing higher customer footfall from accepting digital payments. The study also revealed that 88% of retailers noted a decrease in concerns related to transactional fraud post accepting digital payments.

While digital payment-accepting merchants surveyed are aware of the associated costs with acceptance, 91% believe that the value and benefits derived from digital payment acceptance are at par with or exceed associated costs. In fact, 86% of retailers that accept digital payments are convinced of the overall value of digital payment acceptance, with 93% indicating a strong intention to invest in new payment technologies in the future.

Challenges with Cash Only Acceptance

While cash is associated with convenience, and easy refunds, 25% of cash-only merchants surveyed have lost a transaction because the customer was not carrying cash. Beyond acceptance, managing cash also presents accounting challenges according to half of cash-only merchants.

As a result, almost 78% of cash-only merchants surveyed plan on investing soon in digital payment technology so they can begin to offer consumers a better payment experience. Seventy-five percent (75%) expect digital payment acceptance to increase both footfall and revenue. Merchants also expect digital payments to reduce payment errors and minimize queues which makes businesses look more innovative.

Shashank Singh, Visa’s Vice-President and General Manager for Qatar and Kuwait, said: “Qatar has made great strides in their digital transformation journey driven in large part by a growing number of local consumers increasingly adopting digital payments. Our 'Value of Acceptance' study underscores the critical importance digital payments have for the retail sector and provides key insights into how small businesses in Qatar can unlock significant growth potential.”

Singh added: “Beyond the benefits of security, and convenience, digital payments also provide invaluable data that can assist merchants in targeting offers more effectively, implementing loyalty programs, and enhancing the overall customer experience, among other advantages. These aspects are instrumental in boosting business profitability, competitiveness, and efficiency, and we’re delighted to share the results of our study for the benefit of Qatar’s merchant community and wider economy.”

Merchant Expectations of Digital Payment Provider

Merchants that already accept digital payments expect a range of value-added services from their digital payments provider to enhance their payment infrastructure and offerings for customers. The most frequently cited include: (i) more secure (79%), and efficient B2B payments (75%); (ii), tips on securing payments (75%); and (iii) digital/soft POS (66%). Additionally, mobile payment acceptance (like Visa’s Tap to Phone solution) (32%) and multi-currency processing (14%) were revealed as areas where payment providers can further add value to local businesses.

About the Study

Visa commissioned 4SiGHT Research & Analytics to explore the impact of digital payments on small retailers and gauge their level of openness to digital payment options among those currently accepting cash-only payments. 4SiGHT interviewed 250 nano, micro, and small retailers in December 2023 out of which 41% accepted cash payments only and 59% accepted cash and digital payments. The retailers surveyed were based in Doha and Al Rayyan. The face-to-face interviews took approximately 15 minutes and included a mix of nationalities and genders, representative of Qatar.