Empowering Customers to Invest for a Sustainable Future

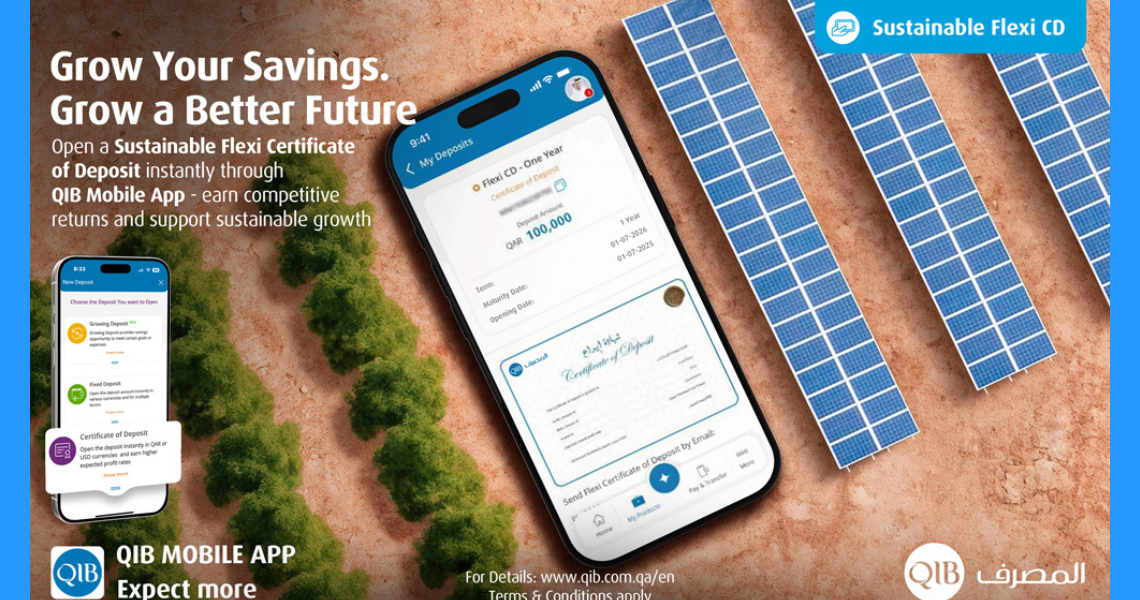

Qatar Islamic Bank (QIB), Qatar’s leading digital bank, has announced an enhancement to its Flexible Certificate of Deposits (Flexi CD), aligning the offering with sustainable finance principles to support green and socially responsible projects.

The enhanced Flexi CD continues to offer attractive returns and flexibility while contributing to a positive environmental and social impact. Funds invested in Flexi CD will now be directed towards financing sustainable initiatives – including clean energy, pollution control, green buildings, education and healthcare; thus, offering customers a way to grow their savings, while supporting a sustainable future.

QIB’s Flexi CD is a flexible investment ‘Mudaraba’ product, allowing retail customers to collect profits at the end of each quarter and make early and partial redemptions during the tenor of the deposit. In the event of early redemption, the remaining balance will continue to earn the same expected profit rate. These Certificate of Deposits can be booked instantly and securely through the QIB Mobile App.

Through the QIB Mobile App, customers can perform up to two partial redemptions with no charges, provided that the value of both redemptions does not exceed 50% of the original Flexi CD amount.

Furthermore, Flexi CD holders can apply for financing up to 100% of the deposit value, with a financing tenor equivalent to the CD maturity. The minimum subscription is QR 100,000 or USD 25,000.

Flexi CD is designed to promote long-term savings and offer attractive annual returns based on currency and tenor. They are available in both Qatari Riyal and US Dollar, with 1, 2, or 3-year tenors.

Mr. D. Anand, QIB’s General Manager – Personal Banking Group, said: “As we continue to advance our sustainability agenda, we are pleased to offer our customers an opportunity to invest in a way that generates financial, environmental and social returns. The enhanced Flexi CD allows customers to grow their savings while contributing to sustainable development, aligning with our long-term commitment to responsible banking. This move is a natural progression of our product strategy meeting the evolving expectations of our stakeholders. It reflects QIB’s role as a forward-thinking financial institution committed to driving positive change.”

The QIB Mobile App enables customers to open deposits and accounts instantly through a simple and secure interface. Customers can choose their preferred currency and tenor to suit their savings goals, with full control and convenience.

For more information, please visit www.qib.com.qa.