Qatar Islamic Bank (QIB), Qatar’s leading digital bank, is pleased to unveil five new features on its Mobile App that will provide a more seamless and simplified banking experience to its customers.

New and First of Its Kind

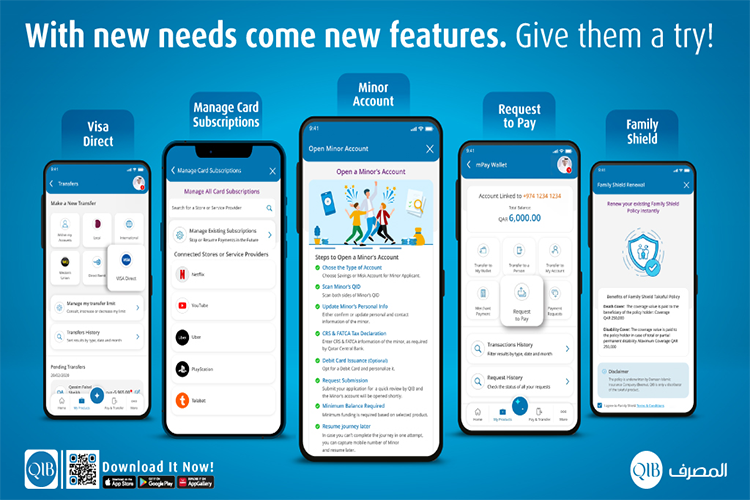

QIB is constantly pushing the boundaries of innovation by partnering with Visa to bring groundbreaking features to its customers. The latest addition to the QIB Mobile App is the Subscription Management feature, a first-of-its-kind in Qatar. With this new feature, customers can easily and conveniently view and manage all their Visa card subscriptions in one place, including popular merchants like Netflix, Talabat, iTunes, and Amazon, among others. Some merchants who store card data even for single transactions, based on customer agreement, will also appear, like airlines and hotels. Rather than having to check each individual subscription separately, users can simply access this feature on the Mobile App and have a comprehensive overview of their subscriptions. Therefore, QIB has taken convenience to the next level by enabling customers to stop payments to any merchant through the Mobile App, and resume payments at a later stage. This gives customers unparalleled control over their subscription payments, allowing them to manage their finances with ease and confidence.

Simplified Banking to Meet Family Needs

To make banking easier for parents and guardians, QIB now allows them to open accounts on behalf of minors with just a few taps via the QIB Mobile App, as well as the ability to view details and manage this account from the convenience of their home.

Another addition is the Request to Pay feature, which allows mPay Digital Wallet customers to request payments from other QIB customers via the app, making it easy to make transfers and split expenses with family and friends. The mPay digital wallet is powered by Qatar Mobile Payment (QMP), and is linked to the customer’s mobile number, enabling him to transfer funds from one person to another who has a QMP wallet from any bank, and enables the customer to scan a QR code to perform a payment to the merchants.

For those looking to secure their family's financial future, QIB has made renewing Family Shield Takaful policies quick and hassle-free. This customized solution, underwritten by Daman Islamic Insurance Company (Beema), helps mitigate financial liabilities in the event of unforeseen events such as disability or death, providing peace of mind to families.

Easy Transfers

QIB has extended its Visa Direct service to 26 more countries, providing customers with the latest and most advanced banking technology. With this streamlined remittance experience, customers can easily transfer funds from their banking accounts to Visa debit, credit, or prepaid cards, delivering near real-time transfers to recipients' Visa cards overseas. This secure and efficient service offers a simple solution for international money transfers, helping customers provide for their families abroad.

Mr. D. Anand, QIB's General Manager – Personal Banking Group said: “The launch of new features on QIB’s Mobile App reflects the bank’s focus on delivering the best solutions for our customers, making it easier for them to bank with us and empowering them with more control over their finances. The QIB Mobile app is a user-friendly and well-designed App that was created to provide our customers with the best experiences. Customers’ needs are rapidly evolving in today’s digital banking environment, and we listen to their feedback and make sure to upgrade and introduce more features on the Mobile App making it easier for them to bank anywhere and at any time.”

“By leveraging our unwavering commitment to investing in the most advanced financial technology available, as well as our culture of relentless innovation, we are able to seamlessly integrate personalized solutions that cater to the unique needs and preferences of each of our valued customers. As we continue to grow, we keep on ensuring that all our customers find banking convenient and remain satisfied every time they bank with us,” added Mr. D. Anand.

Putting the customer at the heart of its digital transformation strategy, QIB is continuously enriching its Mobile App, a digital one-stop-shop, to cater to customers’ banking needs from around the world, at any time with 24/7 accessibility. To download the QIB Mobile App, you can visit the respective App Store and search for QIB Mobile. QIB customers can easily self-register to the App using their Debit card details.