Qatar Islamic Bank (QIB), Qatar’s leading digital bank, has introduced a suite of new features to both its QIB Mobile App and QIB Lite App to further improve accessibility and deliver greater convenience to its customers. These updates reflect QIB’s continued focus on customer-centric innovation and financial inclusion through digital channels.

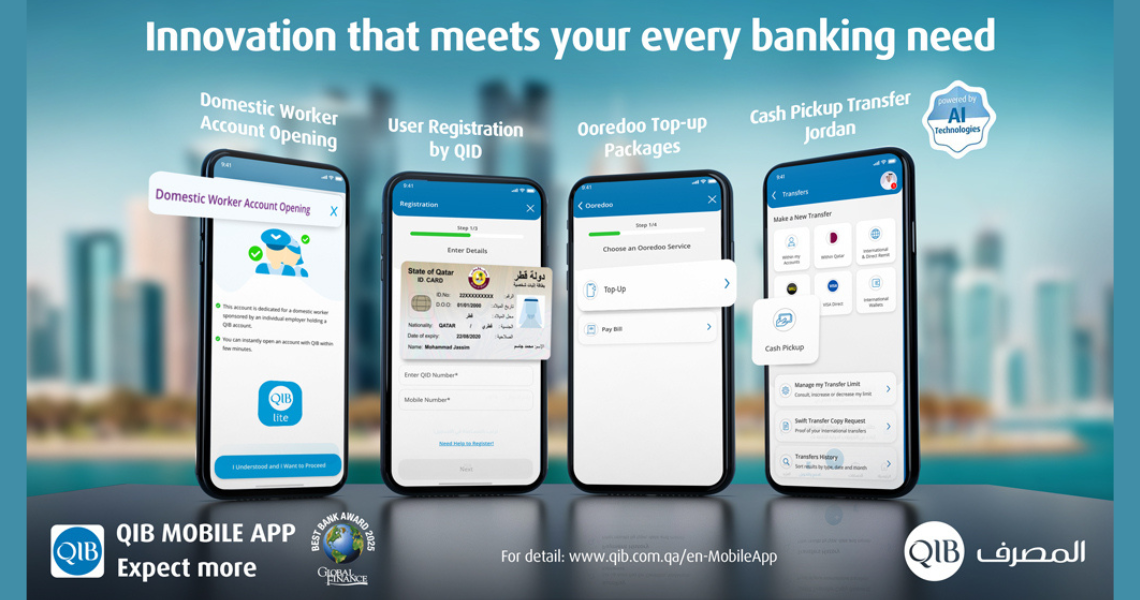

Among the newly introduced services, the Bank has expanded its Cash Pickup Service to Jordan through QIB Mobile App and Lite App, allowing customers to transfer money instantly to beneficiaries in Jordan, who can collect it in cash without needing a bank account. This service builds on QIB’s existing Cash Pickup capabilities and is now available across Jordan, Egypt and Philippines.

On the QIB Mobile App & Lite App, the Bank has upgraded its Ooredoo Top-Up Service through the integration of Ooredoo’s Dynamic API, allowing customers to recharge prepaid lines with real-time, dynamic packages that mirror those available on the Ooredoo app. This feature enables customers to choose from the different packages provided by the telecom operator to instantly recharge their mobile phone lines.

To simplify the registration process to its main app, QIB has introduced a new QID-based Registration Journey on the QIB Mobile App. Customers can ow register using their valid QID, registered mobile number, and active debit card PIN, streamlining access to digital banking and ensuring privacy through secure, multi-factor authentication.

A New Account Opening Journey for Domestic Workers has also been added to QIB Lite App. The update enables domestic workers to open accounts digitally in a secure manner, without the need to visit any branch.

Commenting on the new features, Mr. D. Anand, QIB’s General Manager – Personal Banking said: “The launch of these new features underscores QIB’s strategic focus on delivering relevant and intuitive digital solutions for all customer segments. Each feature has been thoughtfully developed to address specific needs, further advancing our mission to provide secure, inclusive, and accessible banking services across Qatar.”

With over 300 features and a refined user experience, the QIB Mobile App has become the preferred banking channel for most customers, offering a comprehensive and user-friendly platform for all their banking needs. The App offers customers the ability to have full control of their accounts, cards, finance, and transactions to fulfil all their banking requirements remotely. In addition, QIB customers can open a new account, apply for personal financing, a Credit Card, or open additional accounts instantly via the QIB Mobile App.

For more information, please visit www.qib.com.qa/en-MobileApp.