- 98% of surveyed consumers in Qatar take precautions to secure payments

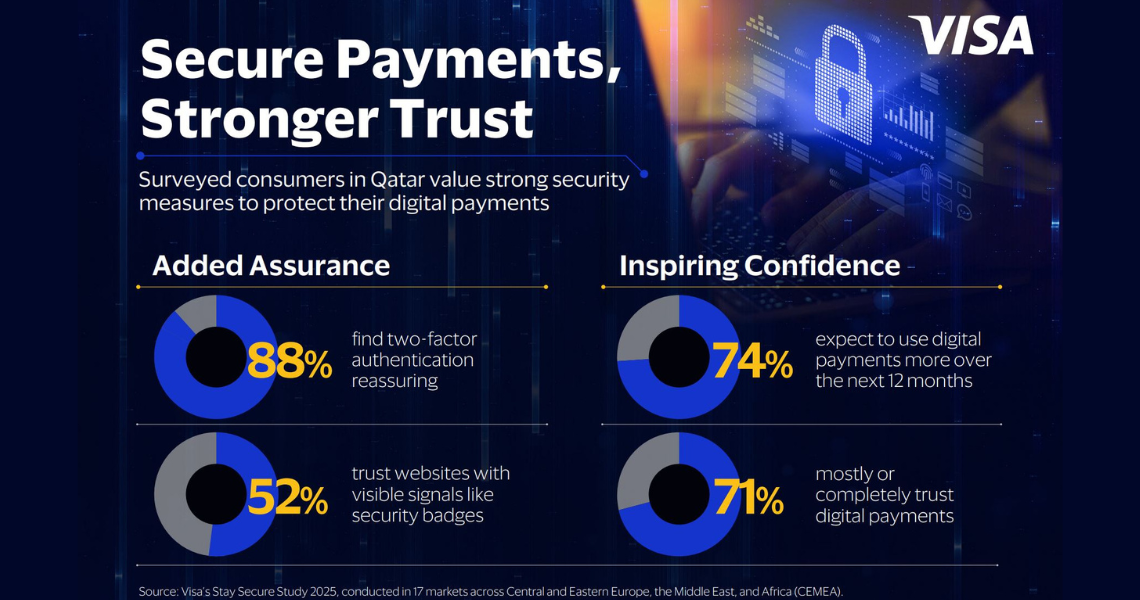

- 71% of respondents trust digital payments and 74% expect to use them more in the next 12 months

- 88% of respondents in Qatar feel more secure making online payments when required to enter a text code or click a link to confirm their identity

Doha, Qatar, March 18, 2025: A new study commissioned by Visa reveals a rise in consumer awareness and proactive security measures for digital payments in Qatar. The ninth annual Stay Secure study, which surveyed 5,800 adults across 17 CEMEA markets, found that 98% of consumers in Qatar now actively take precautions to secure their online transactions, showcasing increased savviness as digital payments gain momentum.

While over half (51%) of surveyed consumers in Qatar acknowledge their vulnerability to scams, the increased adoption of security measures and preference for stronger authentication indicate a positive shift in consumer behavior since the last edition of the Stay Secure study in 2023. Consumers are now actively spotting red flags and verifying the legitimacy of online interactions, showing a marked increase in awareness.

Other key insights emerging from the research bode well for the continued acceleration of digital payments across the region, with almost three-quarters (71%) of all respondents stating that they mostly or completely trust digital payments. Seventy-four percent (74%) of surveyed consumers anticipate that they will increase their use of digital payments over the next year.

"The digital payments landscape is evolving rapidly, and consumers across Qatar are embracing its convenience while becoming more vigilant about security," said Neil Fernandes, Visa's Head of Risk for Middle East and North Africa. "Consumer education is our best defense against fraud, and industry collaboration makes this possible. As scams grow more sophisticated, the battle for security never stops. Consumers increasingly trust partners who take tangible steps to protect them.”

“We are delighted to launch Visa's latest Stay Secure research for Qatar which underscores the important role retailers and financial institutions play in building and maintaining consumer trust in digital payments. Our latest research provides valuable insights that can inform industry strategies to enhance consumer trust and protect the payments system and support the Qatar government's efforts to grow the digital economy," said Shashank Singh, Visa’s Vice President and General Manager for Qatar and Kuwait.

The Stay Secure study highlights evolving consumer preferences, which could offer Visa's stakeholders actionable intelligence for trust-building strategies and inform the creation of educational materials to empower consumers against fraud.

Key Findings of the Visa Stay Secure Study in Qatar:

Falling for scams. With growing reliance on digital payments, scams continue to proliferate. Over half (51%) of consumers in Qatar have fallen for a scam, with 17% being victims on multiple occasions. For example, 65% have been approached by someone requesting them to transfer money on their behalf. Despite this, only 45% admit to being primarily responsible for falling victim to a scam, while 46% believe others are to blame.

Vulnerable Loved Ones. While 61% of surveyed consumers in Qatar have some degree of confidence in their own ability to spot fraud, 97% worry their family or friends might fall for a scam. Eighty-nine percent (89%) believe that Gen X[1] digital payment users are most likely to get scammed online.

Detecting Fraudsters. Consumers are highly wary of suspicious text messages or emails, recognizing these as potential scams designed to steal their money. The biggest red flag for fraud is a notice about issues with an order, subscription, or account, or a notification about a reward, coupon, or gift card. Fifty-one percent (51%) of respondents ranked such messages among the top three most suspicious.

Taking Precautions. Nearly all (98%) surveyed consumers in Qatar take measures to secure their payments. Sixty-two percent (62%) decline to respond to emails asking them to transfer money on someone else’s behalf, while 61% refrain from sharing card or account credentials. Over half (55%) have set up text message alerts that notify them of any account transactions.

Rising Digital Payments. Consumers in Qatar use a variety of digital payment methods, the most common being bank transfers (61%), card payments (60%), and mobile payments (57%). Seventy-three percent (73%) of respondents find digital payments quicker and simpler than other methods and 66% appreciate that they allow payments anytime, anywhere.

Comfort in Digital Payments. Mobile payments are also seen as one of the most secure digital payment methods. Meanwhile, peer-to-peer (P2P) payments are used by 31% of adults in Qatar, yet only 3% consider them the easiest payment option. This highlights an opportunity to improve the user experience and simplify the process for greater adoption.

Building Trust. As digital payments gain traction, retailers, banks, and payment processors can build trust by requiring users to confirm purchases via texted codes or links and displaying trusted security badges. Eighty-eight percent (88%) of consumers in Qatar feel safer when they must confirm their identity through a text code, while more than half (52%) appreciate visible security icons.

Visa’s Commitment to a Secure Digital Future

Visa has been at the center of AI in payments, investing $3.3 billion in our AI and data infrastructure over the last decade. In 2024, it introduced three new AI-powered risk and fraud prevention solutions, as part of the Visa Protect suite, that are designed to help reduce fraud across immediate A2A and card-not-present (CNP) payments, as well as transactions on and off Visa’s network.

As the world's largest SaaS platform, Visa combats cybercrime by deploying cutting-edge tools, expertise, and processes to help identify and mitigate fraud. The impact is undeniable: In the past year, Visa blocked $40 billion in fraudulent payment value, prevented 80 million fraudulent transactions, and averted over $122 million in estimated eCommerce fraud through malware detection.